As states and local governments adopt strict carbon emissions reduction targets, contractors and plumbers will require a range of solutions to meet new building codes. We offer a selection of heat pump and condensing gas water heaters that help you meet building codes and efficiency standards without compromising your customers' comfort. Our water heaters are designed to maximize HERS

® building ratings, achieve certifications such as ENERGY STAR

® and qualify for installer high efficiency incentive programs.

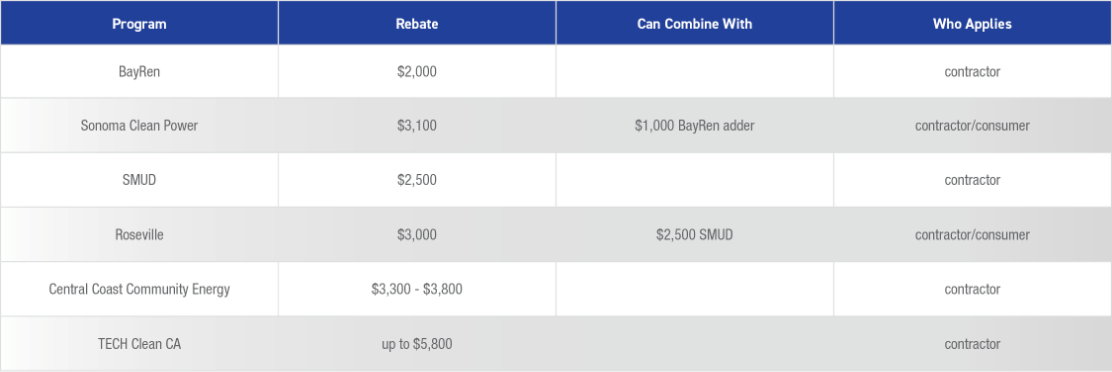

Ask your local utility and state for available high efficiency water heater incentive programs in your area.

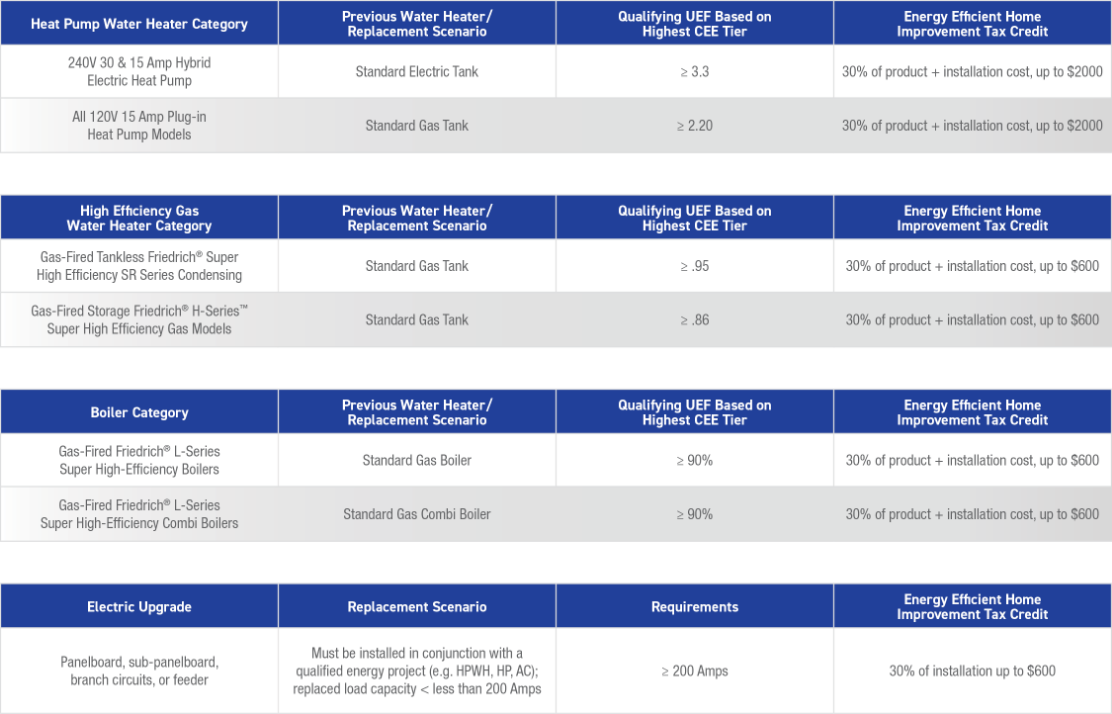

More information about available homeowner tax credits and local rebates are available in the Residential Incentive section above.

PRODUCT ELIGIBILITY INFORMATION