Energy Efficient Home Improvement Federal Tax Credit (Tax Section 25C)

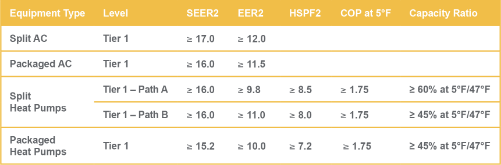

Originally effective January 1, 2023, with updates for 2025 installations effective January 1, 2025, the Energy Efficient Home Improvement Federal Tax Credit (EEHI) gives you a tax credit equal to 30% of equipment and installation costs for the highest efficiency tier products, up to $600 for qualified air conditioners and $600 for qualified furnaces, as well as up to $2,000 for qualified heat pumps. Here are a few things you should know about the EEHI:

Effective January 1, 2023, through December 31, 2025

No lifetime tax credit cap

Not limited to primary residences

No income requirements

Increases the percentage of the credit from 10% to 30% of equipment and installation cost

Annual $1,200 nonrefundable cap for eligible HVAC systems, insulation and air sealing; and a $2,000 tax credit for eligible heat pumps

Effective January 1, 2023, through December 31, 2025

Effective January 1, 2023, through December 31, 2025

No lifetime tax credit cap

No lifetime tax credit cap

Not limited to primary residences

Not limited to primary residences

No income requirements

No income requirements

Increases the percentage of the credit from 10% to 30% of equipment and installation cost

Increases the percentage of the credit from 10% to 30% of equipment and installation cost

Annual $1,200 nonrefundable cap for eligible HVAC systems, insulation and air sealing; and a $2,000 tax credit for eligible heat pumps

Annual $1,200 nonrefundable cap for eligible HVAC systems, insulation and air sealing; and a $2,000 tax credit for eligible heat pumps

Up to $8,000 for electric heat pumps

Up to $8,000 for electric heat pumps

Up to $4,000 for panel replacement

Up to $4,000 for panel replacement

Up to $14,000 per household

Up to $14,000 per household